Comprehensive Exness ECN Account Review Unveiling the Pros and Cons

Exness ECN Account Review

When it comes to trading in today’s fast-paced financial markets, brokers play a crucial role in determining the success of traders. One such broker that has garnered attention is Exness, particularly for its ECN account offerings. In this review, we delve into the specifics of the Exness ECN account, its benefits, potential drawbacks, and how it stands compared to other brokers. For additional insights, especially for traders in specific regions, feel free to check exness ecn account review Exness Libya.

What is an ECN Account?

ECN, or Electronic Communications Network, accounts are designed primarily for experienced traders looking for direct market access. Unlike traditional accounts, which often operate through market-makers, ECN accounts connect traders directly with liquidity providers like banks and financial institutions. This setup ensures tighter spreads and enhanced trading conditions, making it a preferred choice for many day traders and scalpers.

Exness: A Brief Overview

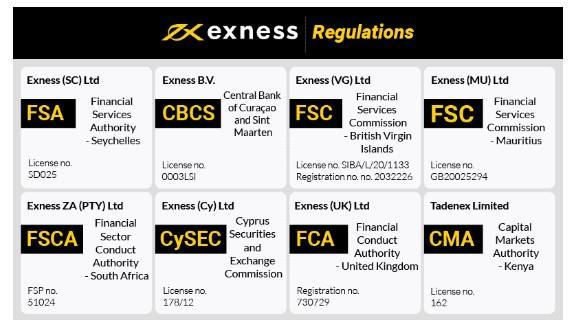

Established in 2008, Exness is a renowned broker that offers various trading accounts to cater to different trader needs. With a global presence and a significant number of active users, Exness operates under strict regulations, ensuring a safe trading environment. The variety of account types includes Standard, Pro, and the ECN account, each designed to optimize trading according to individual preferences.

Features of the Exness ECN Account

The Exness ECN account boasts several standout features that make it appealing to serious traders:

- Tight Spreads: One of the significant advantages of an ECN account is the reduced spreads that can reach as low as 0 pips, depending on market conditions.

- Fast Execution: ECN accounts utilize a direct connection to liquidity providers, leading to faster execution times and reduced slippage.

- Access to Various Instruments: With an ECN account, traders can access a wider range of trading instruments, including Forex, commodities, indices, and cryptocurrencies.

- Leverage Options: Exness offers flexible leverage options, allowing traders to optimize their positions based on their risk tolerance.

- No Restrictions on Trading Strategies: Traders using an ECN account can employ various trading strategies, including scalping and hedging, without restrictions.

Advantages of Trading with Exness ECN Account

The Exness ECN account presents a multitude of advantages that cater to both professional and aspiring traders:

- Market Transparency: Traders benefit from enhanced market transparency due to direct access to liquidity providers, allowing for better trading decisions.

- Scalping and High-Frequency Trading: The ECN environment is perfect for scalpers and high-frequency traders who need quick order execution and the ability to trade frequently.

- Advanced Charting and Analytical Tools: Exness provides a rich set of analytical tools and charts suitable for any trading strategy.

- Robust Customer Support: Exness offers 24/7 customer support to assist traders with any inquiries or issues they may encounter.

- Low Initial Deposit Requirements: The Exness ECN account has relatively low deposit requirements, making it accessible for many traders.

Potential Drawbacks

While the Exness ECN account comes with various benefits, it’s essential to consider some potential drawbacks:

- Commission Fees: Unlike some other account types that offer no commission, ECN accounts may involve additional commission fees per trade, which could affect profitability for lower-volume traders.

- Complexity for Beginners: The ECN account may be overwhelming for novice traders who may not fully understand how to navigate the complexities of direct market access.

- Volatility and Slippage: In highly volatile markets, even though ECN accounts generally provide tight spreads, slippage can occur, resulting in execution at worse prices.

Comparing Exness ECN with Other Brokers

When evaluating a broker, it’s essential to compare its offerings with competitors in the industry. For instance, similar brokers may offer ECN accounts but with variations in spreads, commission rates, and trading platforms. Some traders may find better conditions elsewhere, making it vital to conduct thorough research and possibly even test different accounts with small amounts.

Conclusion

The Exness ECN account undoubtedly provides a robust trading environment for experienced traders seeking speed, transparency, and flexibility. With its competitive spreads, fast execution, and various instruments, it stands out in the crowded broker market. However, potential traders should weigh the pros and cons and consider their trading style before opening an account.

Overall, whether you are a seasoned forex trader or someone looking to transition into more professional trading, the Exness ECN account can be a viable option worth considering. Always remember that successful trading requires both the right tools and a solid understanding of the market dynamics.

Leave a Reply